CG Principle

IFS Capital (Thailand) PCL realizes the importance of operating a business with transparency and fairness. The Company is committed to maintaining standards of good governance and a code of conduct in providing responsible and fair services, disclosing sufficient information, and keeping clients’ information confidential with the awareness that the Company runs the business along with taking care of all groups of stakeholders e.g. shareholders, employees, clients, business partners, creditors, competitors, and the society and environment.

As a result, the Board of Directors of the Company approved the adoption of the principles of Good Corporate Governance based on the Corporate Governance for Listed Companies B.E.2555 (2012) and Corporate Governance Code (CG Code) for Listed Companies and B.E. 2560 (2017) as prescribed by the Stock Exchange of Thailand and the Securities and Exchange Commission respectively as guidelines and code of conduct of the Company. This will not only aim to strengthen and enhance its transparency and efficient and supportive management system but also benefit business operations, giving rise to confidence among shareholders, investors, stakeholders, and related persons. Thus, the Company is certain that good corporate governance will increase value to the shareholders in the long term.

File download

Investment Policy and Governance and Management Policy for Subsidiary, Associate Company or Joint Venture

DownloadThe Board of Directors recognizes the basic rights of all shareholders (natural persons, juristic persons or institutional investors) by encouraging shareholders to exercise their rights: (i) the right to receive a share certificate and to purchase or repurchase by the Company’s sale or transfer of shares, (ii) the right to share in the profit/dividend of the Company, (iii) the right to consider and approve the remuneration for directors every year, (iv) the right to participate and vote in the shareholders’ meeting to elect or remove members of the Board, (v) the right to appoint the Company auditor and determine auditor’s compensation, and (vi) the right to make decisions on other transactions that create a major effect on the Company i.e. dividend payment, determination or amendments to the Company’s Articles of Association or the Company’s Memorandum of Association, capital increase or capital decrease, and approval of extraordinary transactions etc.

In 2024, to maintain the right to attend the annual general meeting of shareholders (“AGM”), the Company held the physical AGM on 22nd April 2024 at 14.00 hours at Infinity Room, 7th Floor, AETAS Lumpini Hotel, No. 1030/4 Rama IV Road, Tungmahamek, Sathorn, Bangkok.

Before the Annual General Meeting

The Company distributes the invitation letter to the Annual General Meeting and other supporting documents, including the three proxy forms: Form A: General and Simple, Form B containing specific details, and Form C for foreign shareholders who have custodians in Thailand. We also distribute the document needed including the details in a clear, correct, and sufficient manner at least 21 days before the meeting date. Additionally, the Company publicizes information on this matter on the website at least 28 days before the meeting date and the invitation letter to the Annual General Meeting in the local newspapers for three consecutive days before the meeting takes place at least three days.

In every annual meeting of shareholders, a shareholder who wishes to authorize any person to attend the meeting and vote on his/her behalf in the meeting or an independent director must fill in details and sign in Proxy Form A, Form B or Form C (either one of them only). Such completed form must be delivered to the Company in advance, or the shareholder may assign his/her proxy to give it to the Company’s staff on the meeting day. To be more convenient, the Company also provides stamp duties, free of charge, for shareholders who grant proxy. In addition, the Company shall not perform any actions that deprive the shareholders’ right to attend the meeting. Every shareholder is entitled to attend the meeting throughout the meeting.

In 2024, the Company allowed shareholders to propose the agenda of the Annual General Meeting and nominate candidates for directorship from 1st October 2023 – 15th December 2023. The criteria for proposing and nominating are disclosed on the Company’s website www.ifscapthai.com under the subject “Investor Relation” → “Shareholder Meetings”, as well as through the SET’s channel which is allowed before the end of the accounting period. After the said period, there was no agenda and nomination proposed by shareholders. In addition, the Board of Directors adheres to the policy not to add new agendas that have not been proposed in advance.

On the date of the Annual General Meeting

The Company allows the shareholders or proxies to register for meeting attendance according to the date and time specified in the meeting via the barcode system.

Before commencing the meeting, the Chairman of the Meeting introduces the Board of Directors, Management Team, auditors, and legal advisors to the Meeting and then the Secretary to the Meeting explains all rules and regulations applicable to the Meeting, including the counting methods for voting in each agenda. The Chairman allows attendees to give opinions or suggestions, and ask queries in each agenda. After that, the Chairman and the management team answers/explains on those matters, then, the Chairman proceeds the voting of each agenda in consecutive order by providing scrutineers/inspectors to count and/or validate the votes without adding new agenda that has not been notified to the shareholders in advance, except the Meeting resolves that the order of the meeting agenda should be changed with the votes of at least two-thirds (2/3) of the total shareholders who attend the meeting.

The 2024 Annual General Meeting of Shareholders went well according to the Company’s Articles of Association. The agenda is comprehensively discussed as detailed in the invitation letter without adding any other agendas or changing significant information without prior notice to shareholders. Details of every Annual General Meeting are recorded in the minutes and the resolutions concluded with the votes. The voting system for the Annual General Meeting was in accordance with Thailand Securities Depositories’ Standards ensuring correctness and transparency in the counting process. Shareholders can see the voting result on each agenda immediately after the counting process is finished.

The Company will inform all shareholders of the meeting resolutions via the SET’s available channels immediately on the meeting date. The meeting’s minutes will be compiled with key information covered, while questions and comments will also be recorded. The meeting’s resolutions will be disclosed on the Company’s website and will be submitted to the SET within 14 days from the meeting date, while the minutes will be kept at the Company’s office premises.

The Board of Directors recognizes the fundamental rights of all shareholders (natural persons, juristic persons, and institutional investors), and ensures that all shareholders’ rights are protected and fairly treated. Every shareholder shall receive all details of the meeting date, meeting agenda, and supporting documents in advance as required by law. The Company distributes the invitation letter to the Annual General Meeting (“AGM”) together with all relevant documents, both Thai and English versions, at least 21 days before the meeting date, and also provides the invitation letter to the AGM on the Company’s website (www.ifscapthai.com) at least 28 days before the meeting date under “Investor Relations” to ensure shareholders have sufficient information and time to study agenda items beforehand. Furthermore, every year the Company allows shareholders to propose the meeting agenda and to nominate candidate(s) to be elected as the Company’s directors within a specified period. Every shareholder also holds equal rights in examining the Company’s operations and expressing opinions and suggestions on each agenda. The meeting minutes shall be prepared accurately and completely for shareholders’ traceability.

To ensure transparency and traceability, the Board of Directors encourages the use of ballots to cast votes in each agenda on a one-share one-vote basis, and the election of directors will be on an individual basis.

The Board of Directors treats all shareholders equally to express their opinions and suggestions through Investor Relations and at the Annual General Meeting of shareholders. A shareholder who cannot attend the meeting is able to authorize a proxy to an independent director or appoint a person as a proxy to attend and vote at the meeting on his or her behalf. The Company will treat any proxy as a shareholder.

The Board of Directors sets a policy to comply with the Company’s Articles of Association, the Securities and Exchange laws, notifications, orders, and the regulations of the Stock Exchange of Thailand and other relevant organizations. Moreover, the Board of Directors focuses on compliance with regulations of connected transactions, acquisition and disposal of material assets, disclosure of connected transactions, and use of inside information for personal or other persons’ benefits. The Board has also stipulated rules to prevent any transaction with conflicts of interest.

The Board of Directors places the policy prohibiting directors, executives, and employees from using the Company’s inside information, which has not yet been disclosed to the public, for their insider trading or to seek their interest or the interest of other persons, either directly or indirectly. The Board of Directors also defines the policy prescribing each director and executive to report his/her trading of shares of the Board through the Company Secretary in advance at least 1 day before his/her trading.

The Company places importance on the rights of all stakeholders of the Company following the deserved rights to receive equal and fair treatment and refraining from taking actions that might violate the rights of stakeholders. Under the corporate governance principles, the Company is committed to implementing the Anti-Corruption Policy approved by the Board of Directors and the corruption risk assessment process as a guideline for all directors, executives, employees, and external parties for practices. Moreover, the Fraud Prevention Policy & Procedures are established to facilitate the development of controls that will aid in the detection and prevention of fraud against IFS Capital (Thailand) Public Company Limited (“IFS”) and to promote consistent organizational behavior by providing guidelines and assigning responsibility for the development of controls and conduct of investigations. IFS adopts a zero-tolerance approach to fraud and will not accept any dishonest or fraudulent acts committed by internal and external stakeholders (further details shown in “Corporate Governance” or “Anti–Corruption Policy” on the Company’s website). The Company has been recertified as a member by the Thai Private Sector Collective Action Against Corruption (CAC) for another 3 years, from 30th December 2023 to 30th December 2026.

The roles of stakeholders can be summarized as follows:

Shareholders

The Company treats all shareholders with fairness and transparency, encouraging shareholders to receive the sufficient and appropriate information, and disclosing significant financial and non-financial information by accurately reporting the actual status and future direction of the Company to each shareholder accurately and completely on time via different channels e.g. the Company’s website.

Clients

The Company provides effective and quick services to serve the needs of its clients on fair conditions to both parties and to maintain clients’ confidentiality, which has been established and disclosed in the Company’s Code of Conduct towards its Clients.

Business Partners and/ or Creditors

The Company treats its business partners and creditors with equality and fairness on the agreed terms and conditions, which have been established and disclosed in the Company’s Code of Conduct towards its Business Partners and/or Creditors. The information is disclosed for public knowledge in the Company’s Code of Conduct, which is based upon principles of fairness and transparency. In this regard, there were no disputes or complaints related to business partners/creditors during the past year.

Employees

The Company fairly treats its employees with an equitable and suitable remuneration and succession plan according to economic conditions and the Company’s performance. The Company intends to make employees perform their work happily by working in a safe environment and developing their knowledge, ability, and skills regularly. The Company also provides provident funds for its employees, and welfare that promotes physical and mental health and recreational activities for employees. In 2024, there were no accidents or illnesses from work.

Competitors

The Company strictly follows the rules of competition, avoids any inappropriate or corrupted methods or destroys competitors’ reputation, which has been established and disclosed in the Company’s Code of Conduct towards its Competitors. In this regard, there were no disputes or complaints related to competitors in 2024.

Regulatory Bodies and Governmental Institutes

The Company complies with the law, announcement, regulations and rules prescribed by relevant regulatory bodies and government agencies; for instance, the Department of Business Development of the Ministry of Commerce, the Revenue Department of the Ministry of Finance, the Securities and Exchange Commission and the Stock Exchange of Thailand, etc. The Company also provides collaboration and cooperation on matters related to good corporate governance and anti-corruption measures.

Society, Community and Environment

The Company continuously encourages employees to engage in activities that enhance the quality of life of the society, community, and environment through its activities or cooperation with the government, private sectors, and communities.

In addition, the Company has established a Code of Conduct for all directors, executives and employees which serves as guidelines for performing their duties with honesty, trustworthiness and fairness. The Company strictly supervises and ensures compliance with the code of conduct, including enforcing disciplinary and punishment actions. The Company has a Whistleblowing policy and procedures that offer protection for whistleblowers (further details are disclosed in “the Company’s Anti–Corruption policy” on the Company’s website) and establishes a Whistleblowing channel for all employees to submit their complaints or concerns relating to any potential unethical or unlawful behavior, financial improprieties or to report perceived violations of law or the Company’s policy directly to the Chairman of the Audit Committee through an e-mail: whistleblowing@ifscapthai.com or regular mail, and information shall be treated as confidential.

The Board of Directors ensures that the Company’s material information disclosures such as financial information, financial reports, and non-financial information both in Thai and English are disclosed to the public in an accurate, transparent and timely manner according to the notifications of the Stock Exchange of Thailand (“SET”) and the Securities and Exchange Commission (“SEC”). The Company discloses such information through online systems of the SET, the Annual Report/the Annual Registration Statement/(Form 56-1 One Report), the Company’s website (investor.ifscapthai.com), the submission of the Notice of the Annual General Meeting of Shareholders via post etc.

For the quality of financial reports, the Company has appointed Deloitte Touche Tohmatsu Jaiyos Audit Co., Ltd. (“Deloitte”) as the Company’s auditors, who have been approved by the SEC, independent and have no relationship with the Company. This ensures that the financial reports are accurate and prepared in accordance with the generally accepted accounting standards. The Audit Committee shall review the Company’s financial reports and financial statements disclosures. The Company has also disclosed the report of Independent Certified Public Accountants, the Management Discussion and Analysis Report (MD&A), the report of the Board of Directors’ Responsibilities for Financial Statements, the report of the Audit Committee, roles and duties of the Board of Directors and the Sub-Committees, Directors’ meeting attendance, as well as the remuneration of the Directors and Executives in the Annual Report.

The Board of Directors requires that directors, executives and employees who know inside information shall not purchase or sell the Company’s securities within 30 (thirty) days period prior to quarterly and yearly disclosure of financial statements and after the financial statements have been publicized for seven (7) days, which is in accordance with the Company’s internal information supervision guidelines. The directors and executives of the Company are also obligated to report their interests and related persons to the Company when taking office for the first time and every change for the Company so that it can be used for consideration of connected transactions that may cause conflicts of interest of the Company.

The Board of Directors recognizes the importance of the disclosure of information with accuracy, completeness, timeliness and transparency. Thus, the Company has established the Investor Relations Department and assigned Ms. Areeya Kanchanabat, who is responsible for the financial statements and general information disclosure of the Company and is a representative of the Company to communicate with shareholders and other stakeholders i.e. institutional investors and analysts etc. Thus, general investors can contact the Company to receive the Company’s information at (66) 0-2285-6326-32 or the Company’s website at investor.ifscapthai.com.

The Board of Directors appointed by shareholders is responsible for the entire business operations of the Company, including authority, approval, corporate governance, and business strategies. They are also accountable for overseeing the management team and assuming the ultimate responsibility of reviewing the risk strategy and financial stability, thus the Board of Directors plays an important role in corporate governance for maximizing benefits to the Company and shareholders.

In 2024, the Company strongly observed the Corporate Governance Principles and was rated “Very Good” in the corporate governance report of Thai listed companies by the Thai Institute of Directors Association, whereas the Company achieved the full score of 100 points (5 medals) or “Excellent” from the quality assessment of AGM by the Thai Investors Association.

Components of the Board of Directors

The Board of Directors consists of personnel with knowledge, capability and experience that are beneficial to the business operations and participated in formulating the vision and mission, strategies, financial goals, risks, plans, and budget of the Company, including ensuring the management’s compliance with the plans and policies with efficiency and effectiveness. The composition of the board of directors shall meet the criteria of the SEC: (i) having independent directors at least one-third (1/3) of the total number of directors but not less than three (3) directors, and (ii) having at least three (3) audit members.

The Company has 6 directors altogether, comprising two (2) female directors and four (4) male directors. The nomination of the directors is in accordance with the shareholders’ meeting resolution which follows the legal procedure and regulations and the Company’s Articles of Association. The number of directors is appropriate for the Company’s business, with aligning components with the SET’s regulations. Other attributes have also been prescribed; age, gender, knowledge, expertise, experience and other qualifications on 31st December 2024, as follows:

Criteria in Selecting Director Candidate

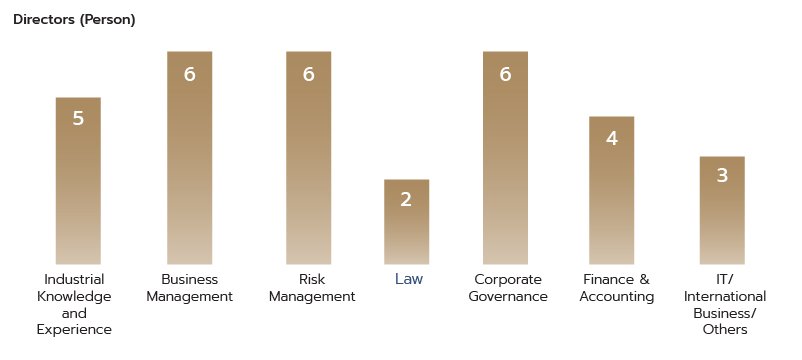

The Compensation and Nomination Committee has devised the selection criteria for the director position, using the Company’s business operations as the basis. Hence, the required qualifications of the suitable candidates have been identified so that they appropriately serve the Company’s strategy in operating the business. The critical qualifications are especially emphasized, and that the Board shall be diverse enough in terms of professional skills, special expertise, knowledge and competencies, gender, and work experiences, in order to appoint the suitable candidate for the position that can contribute to benefits of the Company. With this, the Company has developed the Board Skills Matrix, summarized in the bar charts below, to be used as guidelines for reviewing the Board’s structure and for the nomination of new directors to ensure that the incumbents possess suitable qualifications that are in line with the Company’s direction. In this regard, the people assuming the director or executive positions must possess all the qualifications stated in Section 68 of the Public Company Limited Act B.E. 2535 (including the amendment), the Securities and Exchange Act B.E. 2535 (including the amendments) as well as the Notification of the Capital Market Supervisory, other laws and relevant regulations.

Currently, the Board of Directors consists of 6 directors (Male 4 and Female 2), and female directors account for 33% of the Board of Directors, which is suitable for the Company’s business operations. Every one of them possesses experience in high-level executive positions in both private and public sector organizations. Thus, the current Board members are comprised of qualified individuals with experiences and expertise in different professions covering all aspects comprehensively.

However, the Company allowed shareholders to propose the agenda of the Annual General Meeting and nominate candidates for directorship from 1st October 2023 – 15th December 2023. The criteria for proposing and nominating are disclosed on the Company’s website investor.ifscapthai.com under the subject “Investor Relation” → “Shareholder Meetings”, as well as through the SET’s channel which is allowed before the end of the accounting period.

Board skill matrix

*The evaluation is based on the educational background, work experiences, professional skills and training/seminar records.

In addition, the Board of Directors adheres to the policy not to add new agendas that have not been proposed in advance. Thus, there was no shareholder to propose an additional agenda or a candidate to be elected as the Company’s director for the 2024 Annual General Meeting of Shareholders.

Scope, Duties and Responsibilities of the Board of Directors

The Board of Directors has the power, duties and responsibilities to manage the Company to be in compliance with laws, objectives and regulations of the Company, as well as the resolution of the shareholders’ meeting with lawful approval, honesty and carefulness of the Company’s benefits. The summary of important power, duties and responsibilities is as follows:

4. Review the structure of the Board of Directors, roles, duties and responsibilities of the Board of Directors, directors and senior executives, the appointment of Board committees, nomination, remuneration and development of the directors, director orientation, Board meetings, Board self-evaluation and succession plan.

5. The Board of Directors may delegate one or more directors or any other person to operate a certain task in place of the Board of Directors whilst under the supervision of the Board of Directors. The Board of Directors may authorize such person to have power within the period and to the extent that the Board of Directors deems appropriate. The Board of Directors may cancel, revoke, change, or amend such authorization as it deems appropriate.

In this regard, such delegation must not enable such persons to consider and approve the transactions for themselves, or individuals who may have conflicts of interest, personal interests, or may cause conflict of interest in any other nature with the Company or its subsidiaries (if any) (as defined in the Announcement of the Capital Market Supervisory Board and/or the Stock Exchange of Thailand and/or any other announcement of the related agency) except for approving of transactions that are in accordance with the policies and criteria as considered and approved by the Board of Directors.

8. Arrange for the preparation and submission of the audited financial statements at the end of each fiscal year, that are accurate, complete and in accordance with generally accepted accounting standards, to the shareholders’ meeting for its consideration and approval.

9. To refrain from conducting any similar or competitive business, participating as a partner in an ordinary partnership or partner with unlimited liability in a limited partnership or director in a private company or in any other firms, companies or corporations operating the business similar to or in competition with the Company, regardless of whether for his/her own benefit or for others’ benefit. However, an exception is granted where the director provides notice to the shareholders’ meeting in advance of his/her effective appointment as director of the Company.

10. To notify the Company without delay in the event of the likelihood that the director may have direct or indirect interests as a result of (i) the Company’s entry into any agreement, and (ii) his/her increased or decreased holding of shares or bonds in the Company or its subsidiary companies.

11. Ensure the Company has sound and efficient risk management policies, strategies, and standards coupled with the risk culture.

12. Ensure the Company periodically reviews its internal control system that covers the whole organization and ensure that there is a suitable risk management system or approach with supporting measures and control methods to appropriately and efficiently reduce the impact on the business of the Company.

13. To perform other duties as required by laws.

The Board of Directors approves the corporate plan that reflects the thinking and vision in operating the business with clear and measurable objectives.

The Company places emphasis on operating the business effectively under the principles of good governance, and the Company discourages making transactions with interrelated individuals or transactions that may involve conflicts of interest. In this regard, in the event of such transactions, the Audit Committee will perform a thorough investigation, report and propose to the Board of Directors for approval.

The Board of Directors is responsible for prescribing the good governance policy, including the implementation and practice, covering the display of information related to operating performance in different aspects; financial information, risk management, investment, liquidity, assets and debts, legal compliance, rules and regulations, as well as the review and follow-up to ensure compliance. The Board of Directors shall consider the report and information with care and caution to be aware of key signals, for instance, the tendency for an increase in the interest rates, higher risks in various aspects, failure to comply with the law and regulations, as well as other issues that may impact the Company’s credibility. The Board’s self-assessment shall also be conducted to identify ways for further improvement in the future.

The Board of Directors manages and monitors connected transactions carefully to avoid any possible conflicts of interest by setting measures and procedures as guidelines for approving the entry into connected transactions of the Company, directors and executives, including the future policies and direction regarding connected transactions. Each approval of the connected transaction must comply with the law of Securities and Exchange and the regulations, notifications, orders or announcements of the Stock Exchange of Thailand and other related organizations, including the disclosure of the connected transactions in the financial statements, the annual report, and Form 56-1 One Report for shareholders to examine.

The Company has implemented a code of conduct that serves as guidelines for directors, executives, and staff to follow. The Company’s code of conduct covers fairness toward the shareholders, realization of the rights of all stakeholders, abstinence from any actions that result in conflicts of interest, responsibility towards the Company’s assets, abstinence of usage of internal information for one’s benefit, accurate and timely disclosure of information, and responsibility toward society and the public.

To improve the effectiveness of work performance, the Board of Directors conducts self-assessment on an annual basis, allowing opportunities for the directors to consider the Board’s performance. This self-assessment is a critical tool in evaluating the appropriateness of the Board’s structure and the effectiveness of the Board’s performance according to the principles of good governance. In this regard, the Board will analyze the evaluation outcomes, suggestions, and different points worth observing to consider and adjust to better suit the nature of business operations accordingly.

The assessment of performance on a collective basis.

The areas to be assessed are:

- Board structure and qualifications

- Roles and responsibilities of the Board

- Board meetings

- The Board’s performance of duties

- Relationship with management

- Self-development of directors and executive development

The assessment of performance on an individual basis.

The areas to be assessed are:

- Board structure and qualifications

- Roles and responsibilities of the Board

- Board meetings

Self-Assessment Procedures

The company secretary shall submit the forms of self-assessment of the Board and Sub-Committee to all members so that they can assess their performance during the past year on a collective basis and an individual basis (self-assessment). Then, the completed forms will be sent back to the company secretary for collection, analysis and conclusion which will be reported to the Board of Directors for acknowledgement.

Hence, the result of the 2024 self-assessment of the Board and Committee showed that most of the directors rated “Very Good” on the effectiveness aspect. In this regard, the Board of Directors also offered comments and suggestions to enhance the effectiveness of work performance and to identify ways for improvement in the future.

Attendance of the Company’s Board of Directors

In compliance with related laws, the Company’s Articles of Association, and the corporate governance principle, the Board of Directors holds at least 4 meetings which are scheduled a year in advance to acknowledge and make a decision on business matters of the Company. However, the Board can hold a special meeting when necessary. A letter of invitation with clear agendas and sufficient documents for the meeting will be submitted to directors at least 7 days prior to the meeting date except for an urgent case, to let the Board have enough time to study the information before attending the meeting.

The Board provides an opportunity for executives to participate in the meetings to answer any queries concerned. A minimum quorum required during Board decisions is two-thirds of the total members of the directors. The minutes of the meeting are accurately prepared and filed for further reference.

In 2024, the directors attended the Board meetings, the Sub-Committee meetings, and the 2024 AGM, all of which were held physically below:

|

Directors

|

Positions

|

Board of Directors

(6 members) |

Audit Committee

(3 members) |

**Compensation and Nomination Committee

(3 members) |

Annual General Shareholders’ Meeting 2024

|

|---|---|---|---|---|---|

| Total Number of Meetings (Times/Year) |

5

|

4

|

1

|

1

|

|

| 1. Mr. Randy Sim Cheng Leong |

Director, Chairman of the Board, and Member of the Compensation and Nomination Committee

|

5/5

|

1/1

|

1/1

|

|

| 2. Mrs. Churairat Panyarachun * |

Independent Director, Chairperson of the Audit Committee, Member of the Compensation and Nomination Committee

|

5/5

|

4/4

|

1/1

|

1/1

|

| 3. Mr. Sutee Losoponkul * |

Independent Director, Member of the Audit Committee, and Chairperson of the Compensation and Nomination Committee

|

5/5

|

4/4

|

1/1

|

1/1

|

| 4. Mr. Taveesak Saengthong *1/ |

Independent Director and Member of the Audit Committee

|

5/5

|

4/4

|

0/1

|

|

| 5. Ms. Chionh Yi Chian |

Director

|

5/5

|

1/1

|

||

| 6. Mr. Tan Ley Yen |

Director and CEO

|

5/5

|

1/1

|

Remark:

* Independent Director

** The Board of Directors has engaged in overseeing the risk management of the Company.

Remuneration

The Company determines a clear and transparent director remuneration policy by comparing remuneration packages with those provided by leading listed companies in the SET and comparable companies in the same industry, taking into account the Company’s business performance and experience, duties, roles and responsibilities of the directors in order to attract and retain qualified directors. The remuneration structure is determined in the form of annual remuneration, meeting allowances and bonuses in accordance with the specified criteria.

In 2024, the Board of Directors resolved to approve the annual remuneration and meeting attendance of the directors at the same rate as 2023, which have been approved by the AGM as detailed below:

|

Directors

|

2024

|

Total (Per Director)

|

||

|---|---|---|---|---|

|

Attendance Fees (Baht)

|

Attendance Fees (Baht)

|

Attendance Fees (Baht)

|

||

| 1. Mr. Randy Sim Cheng Leong |

145,000

|

190,000

|

714,000

|

1,049,000

|

| 2. Mrs. Churairat Panyarachun* |

220,000

|

240,000

|

357,000

|

817,000

|

| 3. Mr. Sutee Losoponkul* |

205,000

|

230,000

|

357,000

|

792,000

|

| 4. Mr. Taveesak Saengthong* |

180,000

|

155,000

|

357,000

|

692,000

|

| 5. Ms. Chionh Yi Chian |

100,000

|

80,000

|

357,000

|

537,000

|

| 6. Mr. Tan Ley Yen |

-

|

-

|

-

|

-

|

| Total |

850,000

|

895,000

|

2,142,000

|

3,887,000

|

Remark: No other benefits apart from remuneration above.

* Independent Director

The remuneration paid to the staff (excluding directors and executives)

|

Types of Remuneration

|

2024 (Baht)

|

|---|---|

| Monthly salary/Bonus |

59,326,294

|

| Welfare expenditure for staff |

17,147,957

|

|

Total

|

76,474,251

|

Other Cash Remuneration

The Company is registered under the Provident Fund Act which requires provident fund contribution by both employee and employer. The employees have to pay 5–15% of their salary to the contribution and the Company has to pay another portion as stipulated by the fund’s regulation. In 2024, there were 76 staff in the Provident Fund which accounted for 88 percent of the total staff with the total amount of Baht 54.48 million.

Remuneration of the Auditors

The Company paid remuneration to the Auditors of Deloitte Touche Tohmatsu Jaiyos Audit Co., Ltd. in the form of both Audit Fee and Non-Audit Fee*, such as group reporting fee and out-of-pocket expenses and other actual expenses e.g. overtime pay and traveling expenses as follows:

|

|

Year 2024

|

|---|---|

| Audit Fee |

2,265,000

|

| Non-Audit Fee* |

250,056

|

|

Total

|

2,515,056

|

The Company is aware of the importance of corporate governance and has formulated relevant policies and guidelines in the Company’s corporate governance policy and the code of business conduct and encouraged all related persons to real practice so that it ensures building confidence to all stakeholders. The Company shall monitor to ensure compliance with corporate governance in the following issues:

Control of Inside Information

The Company enforces strict rules on the possession and usage of inside information, particularly financial information before disseminating it to the public. The Company’s policies on inside information are as follows:

- The Company’s directors and executives are obligated to report their interests or those of related persons, such as their spouses, minor children, adopted children, or other persons specified in accordance with Section 89/14 of the Securities and Exchange Act to the Company Secretary so that the Company has information to support compliance with the requirements relating to connected transactions that may cause a conflict of interest or a transfer of the Company’s interests. This aims for the benefit of monitoring the interests of the directors and executives of the Company or of related persons. The reporting is required for the first time since the appointment and for every time when there is a change in information.

- Directors, executives, employees, including their spouses and minor children below the legal age are not allowed to buy, sell, transfer, or accept the transfer of securities of the Company for 30 days prior to the public announcement of the quarterly and year-ended financial statements and 7 days after such information is disclosed. The Company Secretary shall send an e-mail to the directors, executives, employees, including their spouses and minor children below the legal age to acknowledge a blackout period during which trading of the Company’s securities is prohibited.

- Directors and executives shall report to the Board through the Company Secretary at least 1 day before trading of the Company’s shares. In 2024, it was not found that directors, executives, employees, including spouses and minor children of such persons traded securities during the blackout period.

- The Company educates the directors and executives who have the duty to prepare and submit a report on changes of their securities holdings, their spouse and child(ren) under the legal age to the Securities and Exchange Commission (“SEC”) in accordance with Section 59 and the penalty as specified in Section 275 of the Securities and Exchange Act B.E. 2535 (including its amendments), as well as the report on the acquisition or disposition of one’s own securities, those of their spouses, and children below the legal age to the SEC pursuant to Section 246 and the penalty as stated in Section 298 of the Securities and Exchange Act B.E. 2535 (including its amendments). Any violation against the regulations shall have to face disciplinary actions in the form of a warning, salary reduction, suspension of duties, termination of employment etc.

Report on Changes of Securities Holding

The Company’s Board of Directors, executives and those holding the position equivalent to or higher than the Finance and Accounts Manager are required to prepare and submit a report on changes to securities holdings (if any) to the SEC in accordance with Section 59 of the Securities and Exchange Act B.E. 2535 (including its amendments) within 3 days after the change. In 2024, securities holdings of the aforementioned persons are as follows:

|

Name - Surname

|

Position

|

Securities Holdings in IFS

|

|||

|---|---|---|---|---|---|

|

As of 31st December 2024

|

(%)

|

As of 31st December 2023

|

Number of Shares: Increase (decrease) during the year

|

||

| Directors | |||||

| Mr. Randy Sim Cheng Leong |

Director, Chairman of the Board of Directors, and the Compensation and Nomination Committee Member

|

-

|

-

|

-

|

-

|

| Mrs. Churairat Panyarachun* |

Independent Director, Chairperson of the Audit Committee, and the Compensation and Nomination Committee Member

|

-

|

-

|

-

|

-

|

| Mr. Sutee Losoponkul* |

Independent Director, the Audit Committee Member, and Chairman of the Compensation and Nomination Committee

|

-

|

-

|

-

|

-

|

| Mr. Taveesak Saengthong* |

Independent Director, and the Audit Committee Member

|

-

|

-

|

-

|

-

|

| Ms. Chionh Yi Chian |

Director

|

-

|

-

|

-

|

-

|

| Mr. Tan Ley Yen |

Director & CEO

|

210,000

|

0.04

|

210,000

|

-

|

| Management | |||||

| Mr. Tan Ley Yen |

CEO

|

210,000

|

0.04

|

210,000

|

-

|

| Ms. Areeya Kanchanabat |

CFO

|

-

|

-

|

-

|

-

|

| Mr. Paknam Sarakul |

GM, Client Relations

|

105,005

|

0.02

|

105,005

|

-

|

| Ms. Kwanjai Sae-Lai |

GM, Operations

|

-

|

-

|

-

|

-

|

| Mrs. Sutida Supanugoolsamai |

GM, Risk Management

|

99,000

|

0.02

|

112,000

|

(13,000)

|

| Mr. Voon Ee Huei |

GM, Business Development

|

-

|

-

|

-

|

-

|

| Mrs. Pensri Pettong |

Head, Finance & Accounts

|

-

|

-

|

-

|

-

|

| Mr. Kamplon Duncharoen |

Head, Business Development

|

1,050

|

0.0002

|

1,050

|

-

|

| Mrs. Natsaran Pumpichet |

Head, Client Relations Team 1

|

3,005

|

0.0006

|

3,005

|

-

|

| Mr. Meechai Watcharasottikul |

Head, Client Relations Team 2

|

-

|

-

|

-

|

-

|

Remark: As of 31st December 2024, the spouses and minor children of the Directors and Executives did not hold any securities of the company.

* Independent Director

Fraud and Anti-Corruption

The Company fully realizes the importance of the fraud and anti-corruption aspects. The Anti-Corruption Policy (the “Policy”) has been established as the Company’s main policy to show that the Company has a Zero-Tolerance Policy towards corruption and aims to provide guidance for the Company, its Directors, Management and Staff as well as to any person acting on behalf of the Company (e.g., third parties) concerning compliance with anti-corruption laws and to set out monitoring and review procedures to ensure compliance with this Policy. In addition, the Company provided the Anti-Corruption Manual and the Fraud Prevention Policy including the details of the policies and procedures have been disclosed on the website: investor.ifscapthai.com under the topic “Corporate Governance.”

Thus, to build confidence among the Company’s stakeholders in conducting business with responsibility to society, the Company has become a member of the Thai Private Sector Collective Action Against Corruption (“CAC”) and was recertified as the CAC membership for the 2nd time, effective from 30th December 2023 – 30th December 2026.

Ms. Areeya Kanchanabat, Chief Financial Officer, as a representative of IFS, received the certificate of membership of the Thai Private Sector Collective Action Against Corruption (“CAC”), awarded by Mr. Anuwat Jongyindee, a member of the CAC Certification Committee, from the CAC Certification Ceremony 2024 on 12th July 2024.

In 2024, fraud and anti-corruption cases of both inside and outside the Company were not found.

Whistleblowing

The Company has a Whistleblowing policy and procedures that offer protection for the whistleblowers as a Whistleblowing channel for people within the Company and other stakeholders to submit their complaints or concerns regarding any behavior that may cause inappropriate, unethical actions or may cause violation of the law, financial misconduct or fraud directly to the Chairperson of the Audit Committee (the “Chairman”) via an e-mail: whistleblowing@ifscapthai.com or regular mail marked “Private & Confidential” to the address as follows:

Chairperson of the Audit Committee

IFS Capital (Thailand) Public Company Limited

1168/55, 20th Floor, Lumpini Tower,

Rama 4 Road, Tungmahamek,

Sathorn, Bangkok 10120

The Chairperson of the Audit Committee shall consider the complaint by himself and/or appoint an investigation committee which is an independent party to take actions. The full version of the policy and procedures has been disclosed on the Company’s website at investor.ifscapthai.com under “Corporate Governance.”

In 2024, there were no complaints from the Company’s stakeholders following the whistleblowing policy and procedures.

Human Resources

In 2024, there were a total of 86 executives and staff broken down by departments as follows:

|

Types

|

No. of staff

|

|---|---|

| Executives |

10

|

| Business Development |

13

|

| Client Relations |

11

|

| Credit Risk Management |

2

|

| Operations and Information Technology |

28

|

| Customer Credit |

5

|

| Finance and Accounts |

3

|

| Legal & Recovery |

2

|

| IR, Secretariat and Compliance |

2

|

| Credit Review |

6

|

| Human Resources and Administration |

3

|

| Executive Secretary |

1

|

|

Total

|

86

|

In 2024, there were no significant changes in staff strength and there had been no labor dispute.

Policies in Developing Human Resources

The Company recognizes the importance of knowledge and competency development for its employees as it will cause an increase in their competency and quality of services. Therefore, the Company consistently provides in-house and external training and seminars to all staff or individuals to increase skills and knowledge on their jobs. The Company also rewards its employees appropriately to motivate and retain their services in the long run. In addition, the Company also supports activities to motivate and encourage bonding among staff.

Succession Planning

The Board of Directors is aware of the importance of succession planning in the positions of Chief Executive Officer and Senior Managers. To this, the Compensation and Nomination Committee will review the succession planning annually to prepare the recruitment plan once there is a vacant position, retirement, or any executive will not be able to perform his/her duties.